Equiti Trading Solutions

Trading Environment in UAE Market

Equiti Securities Currencies Brokers LLC operates under UAE’s Securities and Commodities Authority (SCA) regulation, providing UAE traders access to global financial markets. The company maintains segregated client funds in Tier-1 banks across UAE, ensuring maximum security for traders’ deposits. Through advanced execution technology, traders receive direct market access with spreads starting from 0.0 pips on major currency pairs. The UAE office, located in Dubai, serves as a regional hub for Middle Eastern traders with multilingual support in Arabic and English. Local payment processing enables instant deposits through UAE-based banks and payment systems.

Table 1: Equiti UAE Trading Specifications

| Parameter | Details |

| Minimum Deposit | $0 (Standard Account) |

| Spread Range | From 0.0 pips |

| Maximum Leverage | 1:30 (Retail clients) |

| Available Platforms | MT4, MT5, Equiti Trader |

| Trading Hours | 24/5 (Sunday 23:00 – Friday 22:00 GMT) |

Available Trading Instruments

The UAE trading platform provides access to multiple asset classes through CFD trading. Currency pairs include major, minor, and exotic combinations with spreads from 0.0 pips on EUR/USD. Commodity traders can access gold, silver, oil, and natural gas markets with competitive spreads. Index CFDs cover major global markets including US30, UK100, and UAE local indices. Share CFDs encompass stocks from NYSE, NASDAQ, and regional exchanges. ETF trading allows exposure to sector-specific investment vehicles.

Currency Pairs Specifications

Major forex pairs available for UAE traders feature EURUSD, GBPUSD, and USDJPY with institutional-grade liquidity. Cross pairs include EURGBP, EURJPY, and AUDUSD with competitive spreads. Exotic pairs incorporate regional currencies like USDAED with specialized pricing structures.

List of Premium Trading Features:

- Dedicated UAE dealing desk support

- Real-time price feeds from major liquidity providers

- Advanced charting with 50+ technical indicators

- Custom indicator development capability

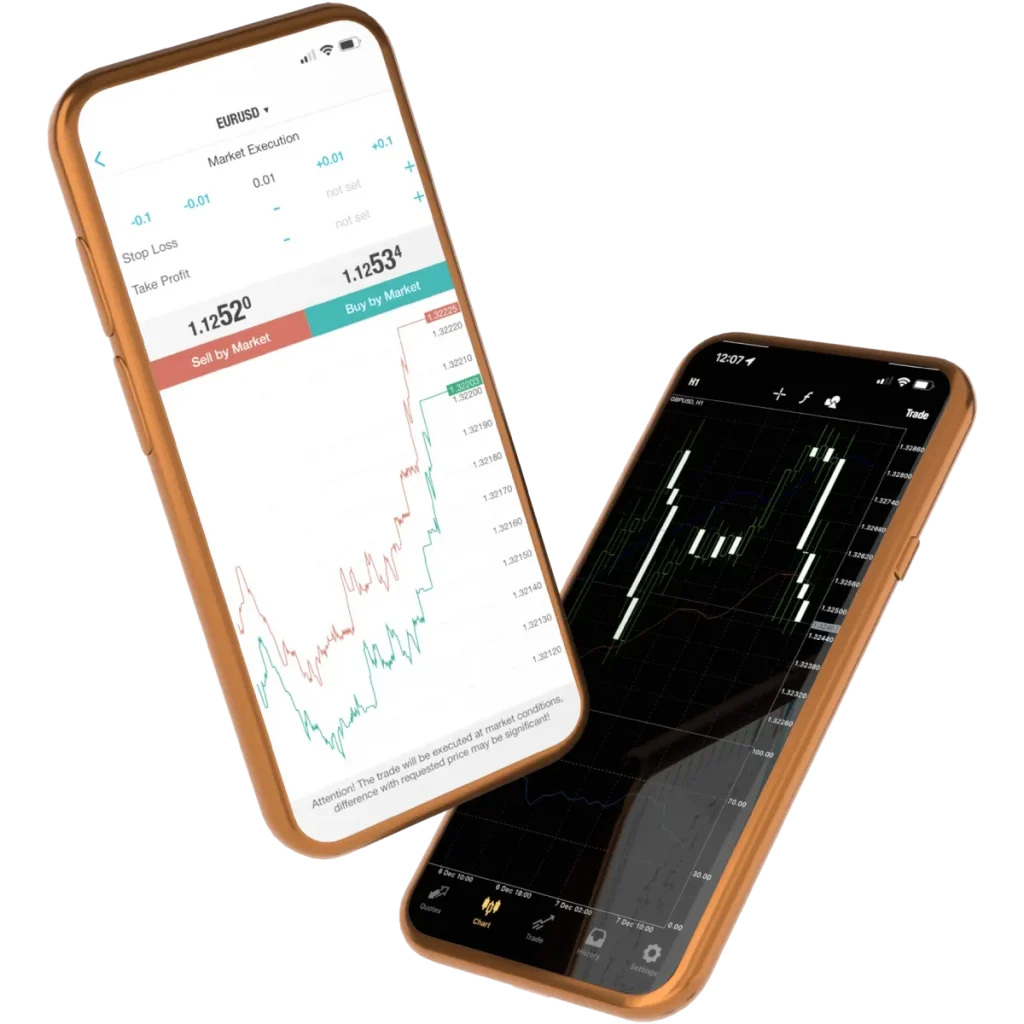

- Mobile trading applications with instant execution

- News feed integration with market analysis

- Economic calendar with local market events

Account Types and Trading Conditions

UAE traders can choose between Standard and Premier account types. Standard accounts require no minimum deposit and offer commission-free trading with average spreads of 1.4 pips. Premier accounts, designed for high-volume traders, require $3,000 minimum deposit and provide raw spreads from 0.0 pips with a commission of $3.5 per lot per side.

Table 2: Account Comparison

| Feature | Standard Account | Premier Account |

| Minimum Deposit | $0 | $3,000 |

| Commission | $0 | $3.5 per lot |

| Spread from | 1.4 pips | 0.0 pips |

| Execution Type | Market | Market |

| Maximum Leverage | 1:30 | 1:30 |

Trading Platform Technologies

Equiti UAE provides MetaTrader 4, MetaTrader 5, and proprietary Equiti Trader platforms. The MT4 platform features 30 built-in technical indicators, 9 timeframes, and algorithmic trading capabilities. MT5 expands functionality with 38 technical indicators, 21 timeframes, and enhanced backtesting capabilities. Equiti Trader mobile application supports iOS 12+ and Android 7.1+ devices with TradingView chart integration.

Platform Security Features

The trading infrastructure implements 256-bit SSL encryption for data transmission. Two-factor authentication protects account access. Automated risk management systems monitor trading activities 24/5. Regular security audits ensure compliance with UAE cybersecurity regulations.

Payment Solutions for UAE Traders

Multiple secure payment options accommodate UAE traders’ needs. Local bank transfers process within 1-2 business days. Credit card deposits through Visa and Mastercard reflect instantly. E-wallet solutions include Skrill and Neteller with same-day processing. Local payment systems support AED transactions without conversion fees.

List of Available Payment Methods:

- UAE bank wire transfers

- Visa/Mastercard deposits

- Skrill e-wallet transfers

- Neteller transactions

- Local payment solutions

- Mobile payment systems

- Prepaid card options

Market Analysis Tools

Professional trading tools include TradingView charts with 100+ technical indicators. Economic calendar displays UAE and global market events. Signal Centre provides up to 40 trading ideas daily. Research Terminal utilizes AI for market sentiment analysis. Assets Overview dashboard presents multi-asset market analysis with opportunity scores.

Technical Analysis Features

Advanced charting packages incorporate Renko, Kagi, and Point & Figure charts. Custom indicator development environment supports MQL4/MQL5 programming. Pattern recognition algorithms identify potential trading opportunities.

Table 3: Analysis Tool Specifications

| Tool Type | Features | Update Frequency |

| Economic Calendar | Global Events, Impact Levels | Real-time |

| Market Analysis | Technical/Fundamental Data | Daily |

| Trading Signals | Entry/Exit Points, Risk Parameters | 3x Daily |

Educational Resources

UAE traders access structured learning materials through multiple channels. Video tutorials cover platform functionality and trading strategies. Weekly webinars address market analysis and risk management. Personal training sessions available in Arabic and English. Trading guides cover fundamental and technical analysis approaches.

Professional Development

Regular workshops conducted at UAE office location. One-on-one training sessions with market analysts. Advanced strategy development consultations for experienced traders.

FAQ:

UAE residents must provide Emirates ID, proof of address (utility bill or bank statement), and completed KYC forms. Additional documentation may be required based on account type and trading volume.

Standard account verification completes within 24 hours. Premier accounts may require additional verification steps, typically completed within 48 hours.

Forex markets operate 24/5 from Sunday 23:00 to Friday 22:00 GMT. Stock CFDs follow respective exchange hours. Commodity trading hours vary by instrument type.